Your Mortgage fell through on closing day images are available in this site. Mortgage fell through on closing day are a topic that is being searched for and liked by netizens now. You can Get the Mortgage fell through on closing day files here. Get all free photos.

If you’re looking for mortgage fell through on closing day pictures information linked to the mortgage fell through on closing day topic, you have come to the right site. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Mortgage Fell Through On Closing Day. Rather you stand to face a penalty from. The seller could also refuse to extend the closing. That sounds stressful Natasha. Without financing your buyer likely wont have the cash to close on the home.

Trid New Lending Timeline Trid Resa Tila New Closing Disclosure Loan Estimate And The New Paying Off Mortgage Faster Mortgage Banking Mortgage Process From pinterest.com

Trid New Lending Timeline Trid Resa Tila New Closing Disclosure Loan Estimate And The New Paying Off Mortgage Faster Mortgage Banking Mortgage Process From pinterest.com

Heres how it works. And sending a nice fruit basket to the seller isnt going to cut it. Whether in the beginning or end reasons for a mortgage loan denial may include credit score drop property issues fraud job loss or change undisclosed debt and more. Here are a few common pitfalls and what you can do to stay on track. A mortgage that gets denied is one of the most common reasons a real estate deal falls through. You should not have to go through underwriting again although your lender will pull your credit just before closing to make sure nothing has changed.

You should not have to go through underwriting again although your lender will pull your credit just before closing to make sure nothing has changed.

If the lien in question is covered under your title insurance policy that should make it go away. Indeed you might even sink it. You may even be able to offer seller financing as a second mortgage for say 7-8. When the close date is missed 9 out of 10 times its the buyers fault. Whether the inspection reveals substantial damage you have trouble obtaining homeowners insurance or your financing falls through all can cause you to miss your close date throwing a strain on the deal. Inspection issues a low appraisal or cold feet can also kill a deal.

Source: pinterest.com

Source: pinterest.com

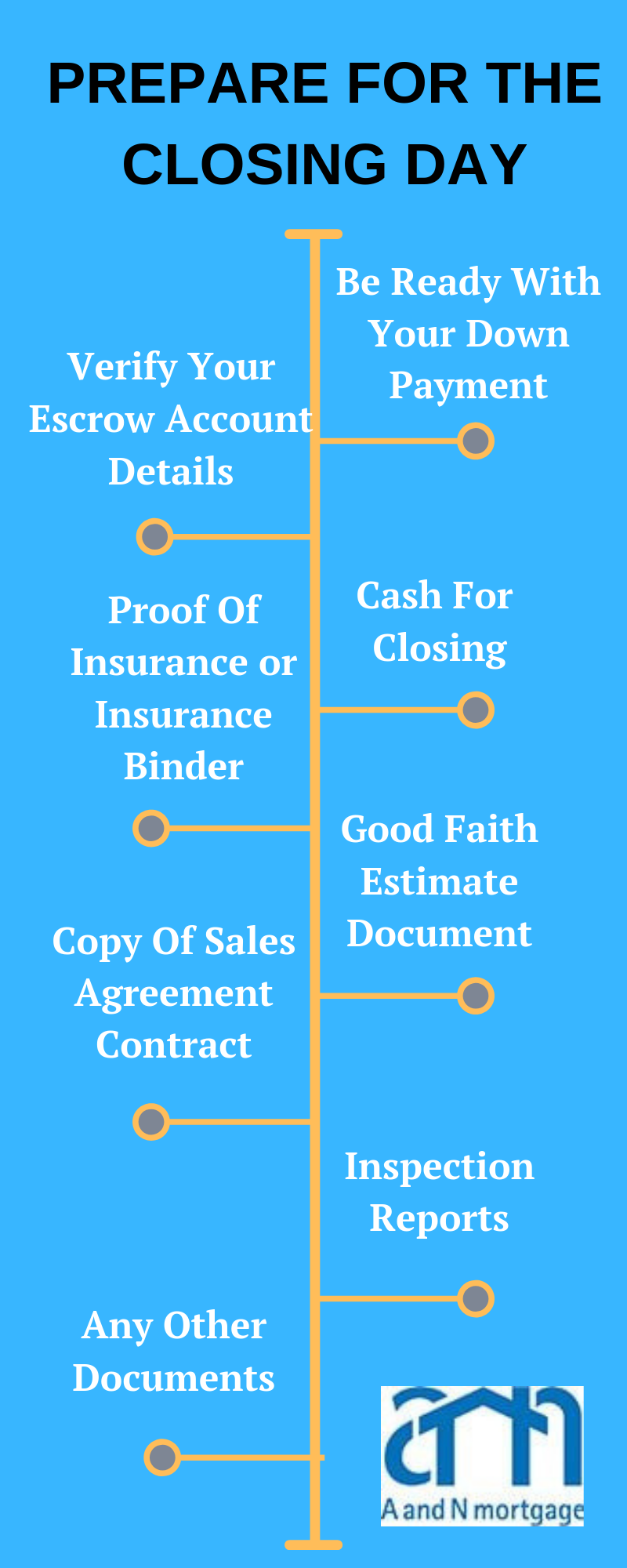

Your buyers financing falls through. The seller could also refuse to extend the closing. On closing day you want to prevent unwanted surprises. Most importantly we explain what to. When the close date is missed 9 out of 10 times its the buyers fault.

Source: pinterest.com

Source: pinterest.com

Whether the inspection reveals substantial damage you have trouble obtaining homeowners insurance or your financing falls through all can cause you to miss your close date throwing a strain on the deal. When you set a closing date and communicate that with your lender you probably assume they will let you know in plenty of time if there are problems with meeting that deadline. Indeed you might even sink it. Its possible that your buyers ability to qualify for a loan could fall through before closing. Mortgage delays and last-minute requests.

Source: pinterest.com

Source: pinterest.com

When the close date is missed 9 out of 10 times its the buyers fault. Whether the inspection reveals substantial damage you have trouble obtaining homeowners insurance or your financing falls through all can cause you to miss your close date throwing a strain on the deal. Most importantly we explain what to. Having your loan fall apart during escrow when your heart is set on a particular home is enough to make you scream or sob or both alternating even. When you set a closing date and communicate that with your lender you probably assume they will let you know in plenty of time if there are problems with meeting that deadline.

Source: pinterest.com

Source: pinterest.com

Many of the reasons a mortgage is. Carefully review your loan documents disclosure forms and other paperwork related to your new home. Regardless of what anyone claims here it is not possible. You may even be able to offer seller financing as a second mortgage for say 7-8. And youre almost bound to delay your home closing if you suddenly change your mind at the last minute.

Source: tr.pinterest.com

Source: tr.pinterest.com

You may even be able to offer seller financing as a second mortgage for say 7-8. The seller could also refuse to extend the closing. Consummation may occur on or after the seventh business day. When a buyers mortgage is denied after pre-approval its in most cases the fault of the buyer or the lender that pre-approved them. In this article.

Source: pinterest.com

Source: pinterest.com

Depending on your purchase contract and whose fault the delay is you may have to pay the seller a penalty for every day the closing is late. When will I get the keys. A mortgage that gets denied is one of the most common reasons a real estate deal falls through. Ugly walk-through revelations The dreaded walk-through is the top reason for surprises on closing day and for good reason. This final inspection of the home happens the day before your.

Source: pinterest.com

Source: pinterest.com

When you set a closing date and communicate that with your lender you probably assume they will let you know in plenty of time if there are problems with meeting that deadline. Often the cause is a buyers inability to close on a mortgage. Rather you stand to face a penalty from. Although both denials hurt each one requires a different game plan. Youve gone through all of the mortgage process and youre ready to closeClosing day is an exciting time when you can officially finalize the deal gain own.

Source: pinterest.com

Source: pinterest.com

And sending a nice fruit basket to the seller isnt going to cut it. Its possible that your buyers ability to qualify for a loan could fall through before closing. And sending a nice fruit basket to the seller isnt going to cut it. If youre worried about your rescheduled closing I would talk to your lender andor your real estate agent about making sure everything is in order and up-to-date. Many of the reasons a mortgage is.

Source: anmtg.com

Source: anmtg.com

When the close date is missed 9 out of 10 times its the buyers fault. Unless your buyer wins the lotteryor secures another lender before closing dayyou can pretty much count on. A mortgage that gets denied is one of the most common reasons a real estate deal falls through. Rather you stand to face a penalty from. Your buyers financing falls through.

Source: pl.pinterest.com

Source: pl.pinterest.com

Say your buyers lose their sole source of income unexpectedly or went on a shopping spree to furnish the house before signing the closing documentsthat increased debt load could cause a lender to question their ability to keep up with mortgage payments. The seller could also refuse to extend the closing. Carefully review your loan documents disclosure forms and other paperwork related to your new home. Understand that in a hot real estate buying or refinancing market lenders can be inundated. When the close date is missed 9 out of 10 times its the buyers fault.

Source: de.pinterest.com

Source: de.pinterest.com

If not youll have to resolve or pay the lien before you can close. Depending on your purchase contract and whose fault the delay is you may have to pay the seller a penalty for every day the closing is late. On closing day you want to prevent unwanted surprises. It would be unfortunate to schedule movers in advance only to discover you need to wait three extra days to move in. In this article.

Source: pinterest.com

Source: pinterest.com

You should not have to go through underwriting again although your lender will pull your credit just before closing to make sure nothing has changed. Having your loan fall apart during escrow when your heart is set on a particular home is enough to make you scream or sob or both alternating even. When the close date is missed 9 out of 10 times its the buyers fault. You may even be able to offer seller financing as a second mortgage for say 7-8. What can go wrong on closing day.

Source: pinterest.com

Source: pinterest.com

If youre worried about your rescheduled closing I would talk to your lender andor your real estate agent about making sure everything is in order and up-to-date. Gregg Fritz if you do find out the reason the lender did not come through there may be things you can do if you so choose to help the deal close. Understand that in a hot real estate buying or refinancing market lenders can be inundated. Most importantly we explain what to. Mortgage delays and last-minute requests.

Source: in.pinterest.com

Source: in.pinterest.com

Consummation may occur on or after the seventh business day. Most importantly we explain what to. Without financing your buyer likely wont have the cash to close on the home. If the lien in question is covered under your title insurance policy that should make it go away. Ask questions if you dont understand any details.

Source: pinterest.com

Source: pinterest.com

Some buyers assume that closing day is move-out day and while that is often the case its possible that youve agreed to something else in the contract and overlooked it in the whirlwind of details. Inspection issues a low appraisal or cold feet can also kill a deal. Understand that in a hot real estate buying or refinancing market lenders can be inundated. The seller could also refuse to extend the closing. Although both denials hurt each one requires a different game plan.

Source: anmtg.com

Source: anmtg.com

Whether in the beginning or end reasons for a mortgage loan denial may include credit score drop property issues fraud job loss or change undisclosed debt and more. Say your buyers lose their sole source of income unexpectedly or went on a shopping spree to furnish the house before signing the closing documentsthat increased debt load could cause a lender to question their ability to keep up with mortgage payments. Your buyers financing falls through. Here are a few common pitfalls and what you can do to stay on track. You may even be able to offer seller financing as a second mortgage for say 7-8.

Source: blog.embracehomeloans.com

Source: blog.embracehomeloans.com

Your home sale just fell through. Many of the reasons a mortgage is. And youre almost bound to delay your home closing if you suddenly change your mind at the last minute. This final inspection of the home happens the day before your. Its possible that your buyers ability to qualify for a loan could fall through before closing.

Source: houselogic.com

Source: houselogic.com

Whether in the beginning or end reasons for a mortgage loan denial may include credit score drop property issues fraud job loss or change undisclosed debt and more. Many of the reasons a mortgage is. And sending a nice fruit basket to the seller isnt going to cut it. Ugly walk-through revelations The dreaded walk-through is the top reason for surprises on closing day and for good reason. Unless your buyer wins the lotteryor secures another lender before closing dayyou can pretty much count on.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title mortgage fell through on closing day by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.